How deep do your pockets need to be to join the wealthiest 1% in Monaco? What impact did Covid have on global wealth? What will the biggest influences on wealth creation be in 2021? We look at the latest Wealth Report to find out.

Each year for the past 15 years, Knight Frank releases its flagship publication The Wealth Report, considered important reading for ultra high net worth individuals (UHNWIs) across the globe and their advisers. In this article, we have identified some of the highlights of this year’s report.

You will be surprised

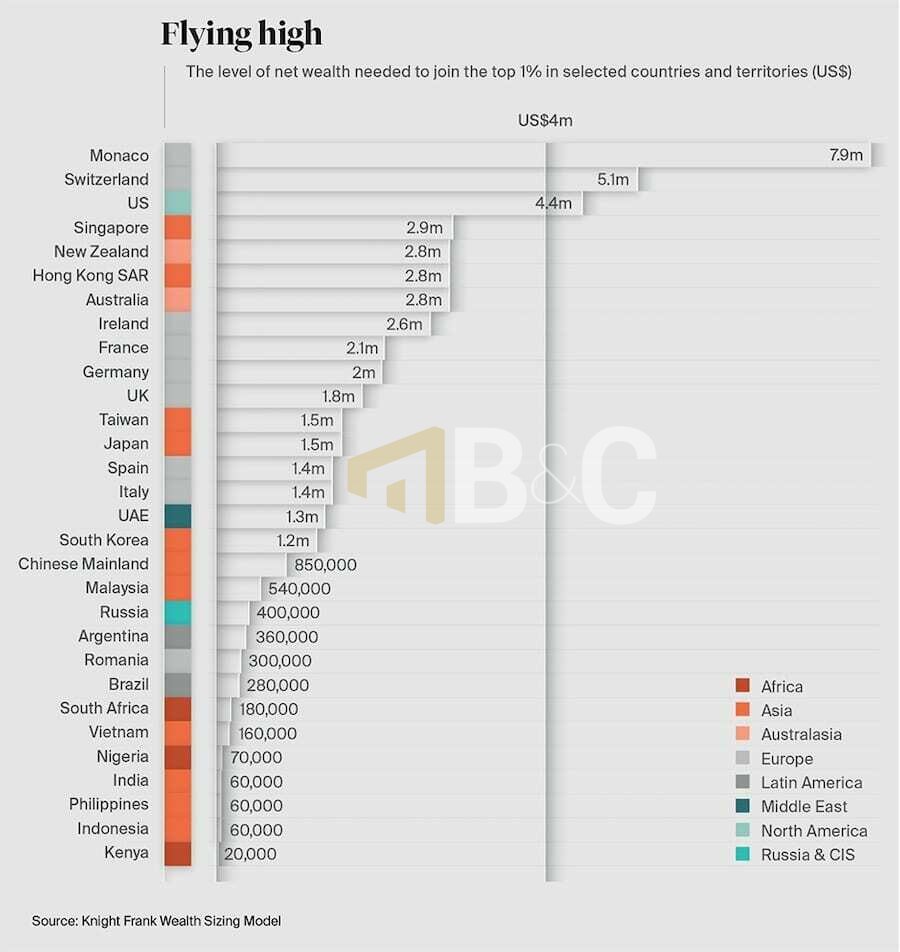

The top 1% is frequently referred to, but never really defined. That’s because the level of net wealth that marks the threshold for entering this rarefied community varies widely among different countries and territories.

Using the Frank Knight Wealth Sizing Model, it is possible to determine how much wealth an individual needs to get into the Principality’s branch of the 1% club.

According to Knight Frank’s definition, an ultra high net worth individual (UHNWI) is somebody whose wealth exceeds US $30 million.

Interestingly enough, it takes far less to enter the 1%.

The level of net wealth needed to join the top 1% in the Principality of Monaco is US $7.9 million (€6.5 million).

In second place is the home of the private bank, Switzerland, where US$5.1 million gains you access, followed by the US, which has the highest number of UHNWI residents. Here, US$4.4 million is your ticket to 1% status.

Impact of Covid on global wealth

With lower interest rates and more fiscal stimulus, asset prices have surged, driving the world’s UHNW population 2.4% higher over the past 12 months to more than 520,000.

While this was virtually one-third the rate of growth seen in 2019, it is still not what experts would have predicted in the first half of the year, given the impact of the virus.

Growth was seen across North America (+4%) and Europe (+1%), but it was Asia that saw the real upswing with 12%, followed closely by Australasia (+10%), the regions which were seemingly able to control the virus the best.

The expansion in wealth was not universal though, with a fall in the number of UHNWIs in Latin America (-14%), Russia (-21%) and the Middle East (-10%) as currency shifts and the pandemic undermined local economies.

“The rollout of vaccines at the start of 2021 is an extremely positive signal, and one that marks the beginning of a new economic cycle in a post-pandemic world,” said the authors of the Wealth Report.

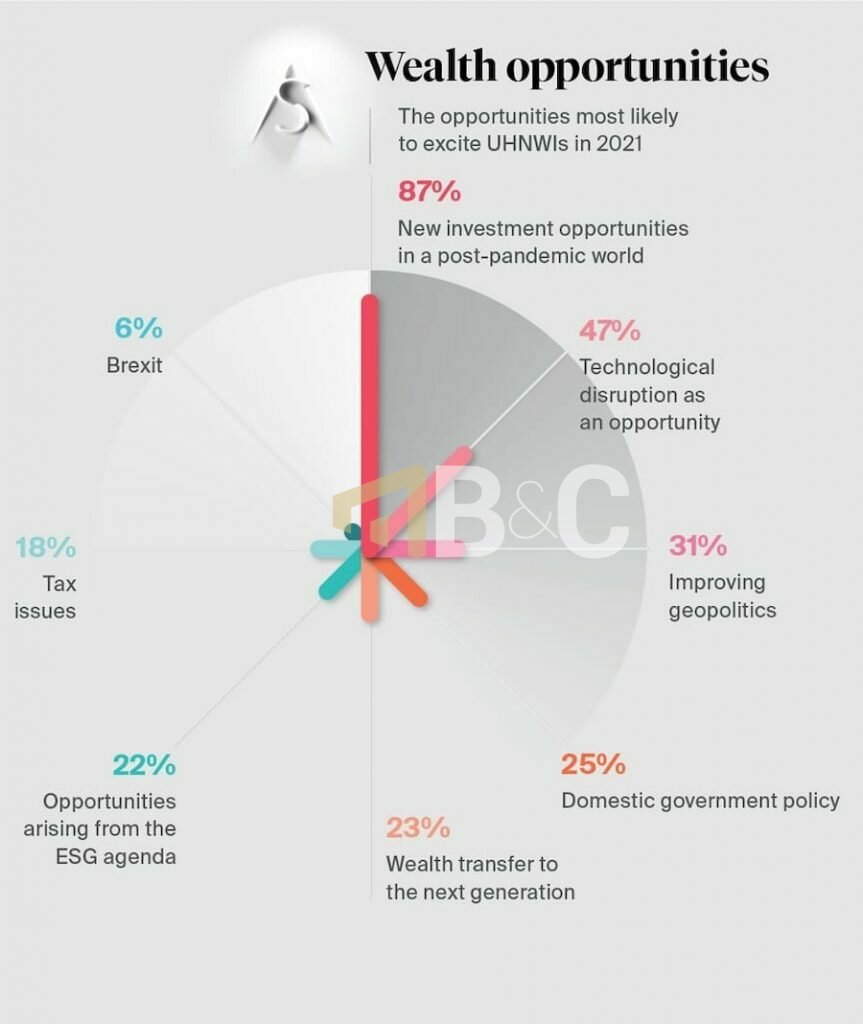

Biggest influences on wealth creation in 2021

The Wealth Report assessed the biggest potential influences on wealth creation and preservation that individuals should be considering in 2021 and beyond. They identified these key areas.

New investments

The Covid-19 pandemic and its related closures, lockdowns and travel restrictions, have given people more time to reassess every element of their lives, including their businesses and investments. As a result, the number of new companies being set up is rising. “We are entering a new economic cycle and the prospects for wealth creation and growth are huge,” says David Bailin, Chief Investment Officer at Citi Private Bank.

The availability and greater adoption of technology is an overwhelming factor in this uptick.

“The ability to gather and analyse financial data is only going to improve,” adds Bailin. “The world of investing will be revolutionised, and the number of investors will go through the roof. Small investors are already becoming more market aware, which can create much more wealth globally.”

By Cassandra Tanti – March 2, 2021

Top photo: Cover of The Wealth Report 2021

Source : Monaco Life